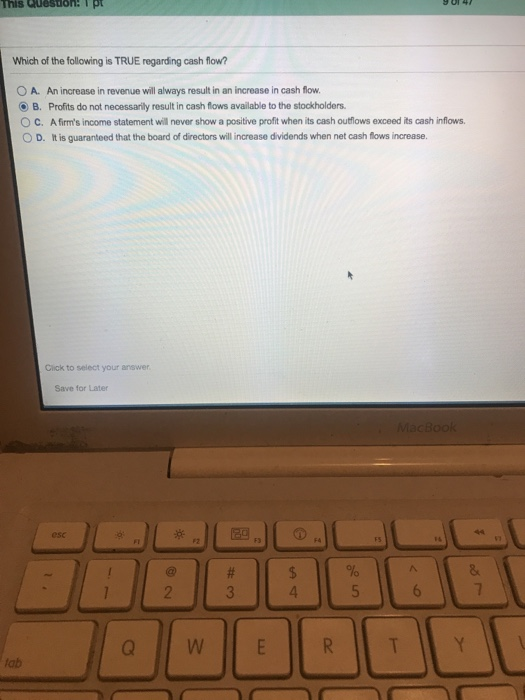

Which of the Following Is True Regarding Cash Flow

Up to 256 cash back Which of the following statements regarding the cash flow statement is true or false. Noncash investing and financing activities need to be.

Cash Flow Statement Classification Format Advantages Disadvantages More

Analyzing noncash accounts can be challenging when a.

. The statement of cash flows reports why cash increased or decreased during the period. A statement of cash flows measures the profitability of a company using the cash basis of accounting. The purchase of property plant and equipment is classified as a financing activity.

Investing activities include transactions that affect issuance of common stock. All of the following are true regarding the statement of cash flows except. Multiple Choice Operating activities include transactions and events that affect net income.

Cash flow from operating activities cash flow from investment activities and cash flow from noncash activities c. Accounts Payable is classified as a cash flow from financing activities. The total increase or decrease in cash shown on the statement of cash flows must agree with the.

The statement of cash flows has two major sectionsoperating and non-operating. D Both a and c are correct. A The discount rate is adjusted to accommodate the riskiness of the cash flows.

Paying dividends to owners is considered a financing activity on the Statement of Cash Flows. Under IFRS noncash investing and financing activities are excluded from the statement of cash flows and instead are presented in. The statement of cash flows separates cash inflows and outflows into three major categories.

The statement of cash flows reports the changes in. Noncash investing and financing activities need to bedisclosed under other activities D. Which of the following is true regarding the traditional discounted cash flow approach.

Cash flow from operating activities cash flow from investment activities and cash. Operating activities can be reported using either the direct or indirect method. The statement of cash flows has three major sectionsoperating investing and financing.

Profits do not necessarily result in cash flows available to the stockholders. A statement of cash flows measures the profitability of acompany using the cash basis of accounting. Risk the magnitude and timing of cash flows are the key determinants of share price which represent the wealth of owners in a firm.

Regarding the statement of cash flows which of the following is true. Financing activities include transactions that affect long-term liabilities and equity. C This model is best used where cash flows are fairly uncertain.

Which of the following is true regarding the statement of cash flows under US. A firms income statement will never show a positive profit when its cash outflows exceed its cash inflows. Two different methods may be used to compute the net cash flowsfrom operating investing and financing activities.

The profit maximization goal ignores the timing of returns does not directly consider cash flows and ignores risk. Where is a conversion of bonds into common stock reported on a statement of cash flows. Two different methods may be used to compute the net cashflows from operating investing and financing activities.

Which of the following statements regarding the statement of cash flows is true. B The cash flows have been adjusted to accommodate their riskiness. Cash also includes cash equivalents on the Statement of Cash Flows.

Purchasing inventory is considered an investing activity on the Statement of Cash Flows. Working capital changes are accounted for as cash flows from operating activities. Noncash investing and financing activities need to be disclosed under other activities The statement of cash flows reports the changes in cash.

The statement of cash flows has two major sectionsfinancing and investing. An increase in revenue will always result in an increase in cash flow. It is guaranteed that the board of directors will increase dividends when net cash flows increase.

A statement of cash flows measures the profitability of acompany using the cash basis of accounting. Cash flow from equity activities cash flow from investment activities and cash flow from financing activities b. Operating investing and financing.

The correct option is the 4th Option. QWhich of the following is true regarding the statement of cash flows and IFRS. The three categories of a firms statement of cash flows are Select one.

The profit maximization goal ignores the timing of returns does not directly consider cash flows and ignores risk. The ending cash balance shown on the statement of cash flows must agree with the amount shown on the balance sheet for the same fiscal period. In this worksheet the upper portion is the balance sheet information and the lower portion is the cash flow statement information.

Which of the following statements is TRUE regarding a statementof cash flows. Two different methods may be used to compute the net cash flows from operating investing and financing activities. Risk the magnitude and timing of cash flows are the key determinants of share price which represent the wealth of the owners in the firm.

Solved Which Of The Following Is True Regarding Cash Flow O Chegg Com

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Proper Payroll Accounting Methods Are Important For A Business For All The Reasons Below Except In 2022 Payroll Accounting Payroll Payroll Taxes

No comments for "Which of the Following Is True Regarding Cash Flow"

Post a Comment